Description

Overview of Hsutron IC and ADM202EARNZ

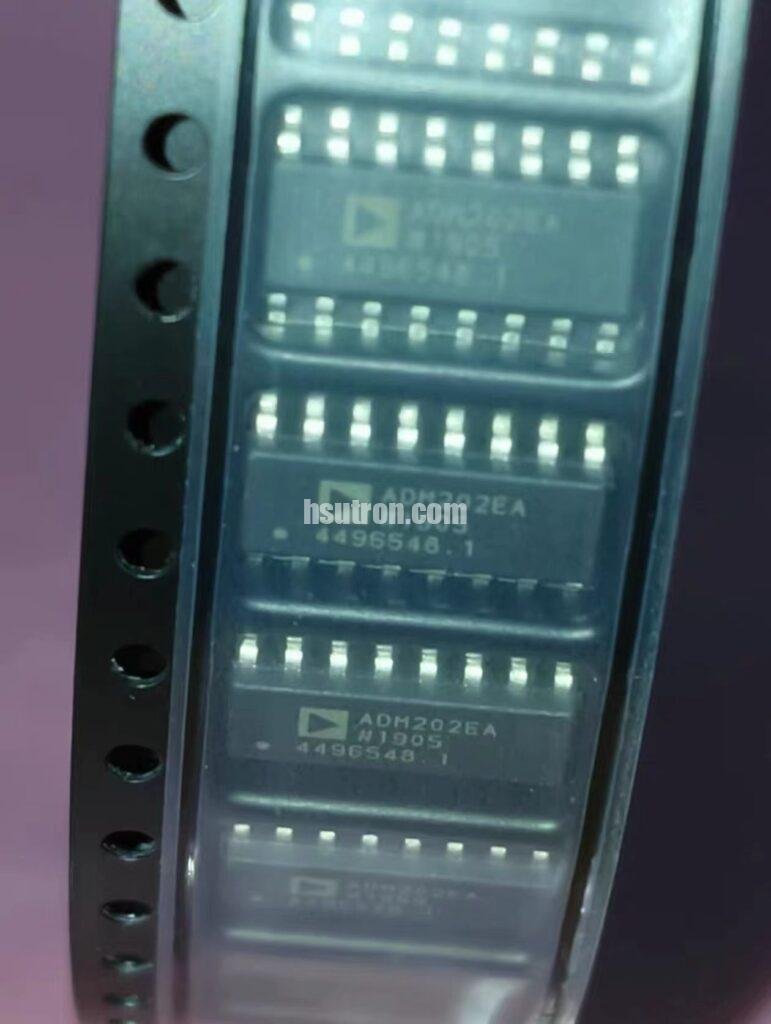

Hsutron Integrated Circuits ADM202EARNZ is a recognized player in the semiconductor sector, specializing in the design and manufacture of high-performance analog ICs and mixed-signal integrated circuits. The company’s offerings are widely utilized in numerous applications, including communications, automotive, and consumer electronics, demonstrating Hsutron’s versatility and innovation within the market. As technology continues to evolve, Hsutron remains dedicated to providing cutting-edge solutions that meet the growing demands of varied industries.

The ADM202EARNZ is one of Hsutron’s flagship products, known for its dual-channel, low-power RS-232 line driver. This integrated circuit is essential for enabling reliable communication between devices over longer distances while ensuring optimal power efficiency. Its design adheres to stringent standards, allowing it to function effectively in numerous embedded systems and portable devices. The ADM202EARNZ’s functionality makes it an attractive option for manufacturers and engineers looking to enhance device performance in demanding environments.

Historically, the performance of the ADM202EARNZ stock has mirrored the broader trends in the semiconductor marketplace, characterized by periods of robust growth interspersed with volatility. Factors influencing its valuation include technological advancements, production cost fluctuations, and competitive pressures from alternative semiconductor firms. Additionally, the potential for supply chain disruptions, particularly in the global chip market, plays a critical role in determining stock performance.

In comparison to its competitors in the semiconductor sector, the ADM202EARNZ stands out due to its unique features and Hsutron IC’s commitment to quality and customer service. The company’s proactive approach in innovation positions it favorably as it continues to develop products that address not only current market needs but also anticipated future trends. Understanding the ADM202EARNZ’s specifications and market context is crucial for investors seeking to gauge its potential and align with current trends in the semiconductor industry.

Hsutron IC Stock ADM202EARNZ

Investment Analysis and Future Outlook

The ADM202EARNZ stock, part of the Hsutron IC portfolio, presents a compelling case for investors, bolstered by various financial metrics and recent market trends. Assessing the stock’s performance necessitates a close examination of quarterly earnings reports, revenue growth patterns, and profit margins. Historically, the ADM202EARNZ has demonstrated steady revenue increases, driven by expanding demand in the semiconductor industry, particularly as technology advances toward greater automation and connectivity.

Recent market trends indicate a resilient demand for semiconductor components. Factors such as increased consumer electronics sales, the proliferation of electric vehicles, and the integration of Internet of Things (IoT) devices are pivotal in shaping the demand for Hsutron IC products. Macroeconomic factors, including supply chain challenges and geopolitical tensions, have the potential to impact stock performance. However, the stability of the semiconductor sector in the face of such challenges suggests that the ADM202EARNZ stock could remain a robust investment opportunity moving forward.

Investment risk is an inherent element of stock analysis. Critical risks associated with the ADM202EARNZ stock include market volatility, potential regulatory changes, and technological obsolescence. Analysts note that the rapid evolution of technology necessitates constant innovation, which can strain profit margins during development phases. On the flip side, adaptive strategies and continued investments in research and development may render Hsutron IC’s stock resilient against competitor advances.

Expert opinions reflect cautious optimism regarding future performance, with several analysts projecting sustained growth for Hsutron IC and its ADM202EARNZ stock. Predictions emphasize a continued upward trajectory, contingent on successful product launches and efficient supply chain management. This analysis helps investors understand the duality of risks and opportunities associated with the ADM202EARNZ, ensuring informed decision-making in the dynamic technological landscape.

Who is Hsutron?

Hsutron is the registered brand of Shenzhen Chengsuchuang Technology Co.,Ltd.Provide the electronics hardware since 2014 year.We focus on electronic components B2B business at earliest.In recent years,B2C business grows well than expected,then we lanched the site for B2C online shopping.

We support Bank transfer and Credit cardpayment,like Paypal and other method credit card payment.

Reviews

There are no reviews yet.